In the development projects I have been involved with, some of the best thinking is done in the car, during the countless hours spent in long rides to and from the field. Or in the evenings after a day with farmers, which invariably educates and provokes new ideas.

When I was working on the CAFE Livelihoods project in Central America, where coffee plantations are aging and average yields are a fraction of what they could be, these conversations often revolved around farm renovation. And what it would take to systematically replace old coffee plants in Central America and Mexico with new ones.

There seemed to be no limit to the need for investment in renovation — I recall once calculating on the back of a napkin over dinner that smallholder farmers in Mesoamerica could easily put $100 million to good use for this purpose. And the demand was there — farmers understood that the shortest path to increased coffee revenue was improving productivity, and they were constantly seeking support for farm renovation. What seemed to be missing was a financial product that was accessible to smallholder farmers and responsive to the cash flow their new coffee plants would generate. We talked on and off for years about what such a loan would look like. Then I found it in Colombia.

As coffee buyers and industry watchers are well aware, Colombian coffee production has declined steeply in recent years, due first to the coffee leaf rust disease and then to the renovation campaign that the National Coffee Growers Federation has undertaken in response — an effort that is replacing traditional cultivars susceptible to rust with a new rust-resistant cultivar, but has temporarily taken countless thousands of hectares out of production in the process.

The financial product driving this renovation process looks just like the one my colleagues and I dreamt up in Central America. Only better.

It is a loan that is repaid over a period of seven years.

During the first two years, as the plant grows but does not produce any meaningful volume of coffee or revenue, farmers do not pay capital or even interest on the loan.

Farmers begin paying back the loan during year three, when the plant is nearing full productivity. And when they do, it is with low interest rates (currently about 11 percent per year) and one annual payment during the coffee harvest — the one time in the year farmers can be sure they will have enough cash on hand to repay their loans.

And the best part, from the farmer’s perspective, is the subsidy. Farmers pay back only 60 percent of the loan’s capital, with a public-private collaboration covering the remaining 40 percent of the capital.

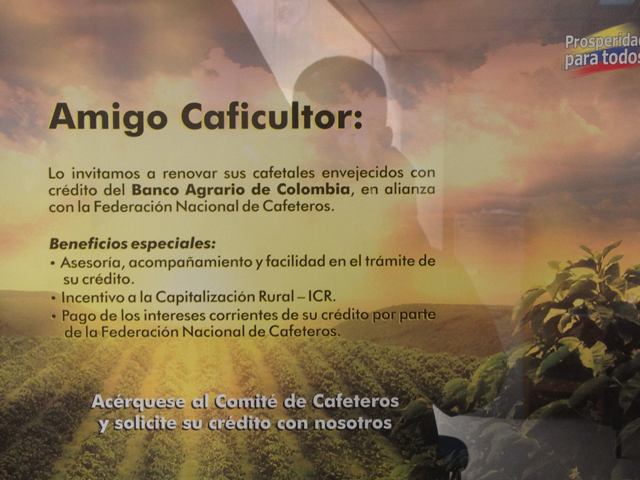

FINAGRO, a public agency promoting rural development, provides the capital for the 40 percent subsidy. Banco Agrario, a commercial bank, provides the remaining 60 percent and administers the loans. And the National Coffee Growers Federation provides field-level verification that the loan was in fact used for coffee renovation, as well as technical assistance to ensure the coffee performs well and the bank gets a return on its investment.

It is hard to imagine a better loan product for renovation. During three years and thousands of kilometers of car rides through the coffeelands of Central America, I couldn’t.