Yesterday I had the honor to present the preliminary results of the Colombia Sensory Trial at the 2015 SCAA Symposium.

The Colombia Sensory Trial is a cross-sector collaboration with allies in the research community (the International Center for Tropical Agriculture, Kansas State University and World Coffee Research), industry (Counter Culture, Federación Nacional de Cafeteros, George Howell Coffee, Intelligentsia, Keurig Green Mountain, Red Fox Coffee Merchants, Starbucks and Stumptown) funded by the Howard G. Buffett Foundation. We led the implementation of the Trial on the ground in Nariño, Colombia, in connection with our Borderlands Coffee Project there.

Today, a summary of the key points I presented yesterday at Symposium (and didn’t).

.

.

WHAT I SAID THAT REALLY MATTERS.

- Growers in Nariño face a simple question–Castillo or Caturra?–that is deceptively complex.

- They have come to understand–perhaps incorrectly–that Castillo, a variety developed by breeders at Colombia’s coffee research center Cenicafé, offers mostly disease resistance and high yields while Caturra’s principal differentiator is its cup quality.

- Castillo has powerful support from Colombia’s coffee institutions, which provide certified seed, agronomic assistance and free money in the form of a subsidized renovation loan to growers who plant it. This support is not available for Caturra.

- Growers in Nariño can’t afford to get this question wrong. They have small farms (0.9 hectares planted in coffee on average), low production (less than 9 bags/hectare) and are mostly poor (61 percent) and hungry (57 percent report food shortages).

- The Colombia Sensory Trial has one modest goal–to contribute solid information that supports decision-making processes on three levels: (1.) on the farm, where growers just want to know, in the words of the great Tim Schilling of WCR, “which variety will give them the best bang for their buck;” (2.) in the policy-making process, where the Castillo-only posture of Colombia’s coffee institutions has contributed mightily to Castillo’s rise and Caturra’s demise; and (3.) in the marketplace, where the preference among many specialty buyers for Caturra may not be based on accurate perceptions of the two varieties’ potential for cup quality.

- During the 2014 harvest, collected samples from 22 farms growing both varieties under similar agroecological conditions that were harvested and processed identically and strictly separated throughout the harvest and post-harvest processes. This approach allowed us to control (to some degree) and isolate (to some degree) the impact of genetics, or variety, on cup quality.

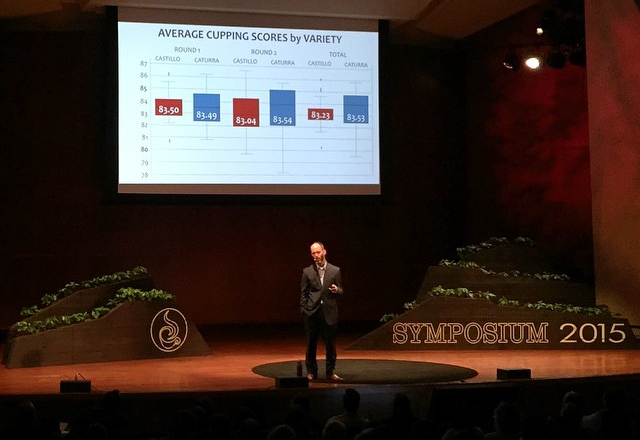

- Each sample was cupped blindly four times by buyers and quality control experts from the industry actors named above during 3-day panels held at Intelligentsia Roasting Works in Chicago. The panel was led by noted Cup of Excellence judge Paul Songer. The first was held in October 2014 and the second in January of this year. We did two panels over three months rather than just one was to see whether there was any difference in the way the varieties performed after several months of storage in similar conditions.

- The sample size was too small to generate the kind of robust results we were hoping for. The results do not say anything about the potential of these varieties outside of Colombia. Or even outside of Nariño. Or even in Nariño this year–they represent the results of one trial of a small number of samples in one region during one harvest season.

- The data did not produce evidence of (statistically significant) difference in overall cupping scores between the two varieties.

- The data did not produce evidence of (statistically significant) difference between the rates at which the quality of the two varieties fades.

- The data did not produce evidence of (statistically significant) difference between the two varieties in average scores across sensory categories.

- The data did not produce any evidence of difference between the varietal preferences of companies in the “specialty” segment of the market (Counter Culture, George Howell, Intelligentsia, Red Fox, Stumptown) and those in the “high-volume specialty” segment (Federación Nacional de Cafeteros, Keurig Green Mountain, Starbucks).

- On the farm it is hard on the basis of these results to argue for significant investment in Caturra over Castillo in the name of quality, which imposes significant production risk without increasing in any statistically significant way the probability they can produce higher cup scores (or receive price premiums for cup quality).

- In the policy process it is hard to argue on the basis of these results against the Castillo-only policy of Colombia’s coffee institutions vis-a-vis Caturra.

- In the marketplace, this study contributes an important perspective to the conversation around Castillo: Castillo can be good. Very good.

- Coffee buyers think they prefer Caturra should be sure of their preference for Caturra and pay more for it to compensate growers for the additional risk they assume when they plant it and the perceived quality differential.

- If growers (like these 33 farmers in La Florida, Nariño) and roasters (like our friends at Counter Culture who bought their coffee) are connected in mutually beneficial trading relationships focused on Caturra varietal lots, those relationships should be nutured and grow. But the incentives for Caturra may have to be rethought in a more fundamental way if Caturra is to continue to be attractive to growers on a broader scale.

- Cuppers, in the words of Counter Culture QC Director and Green Coffee Buyer Tim Hill, are terrible as instruments of sensory analysis. Cuppers failed to generate statistically signficant separation between the quantitative scores they gave Castillo and Caturra, but the sensory analysts at Kansas State University succeeded through the application of the new SCAA Sensory Lexicon in establishing a statistically significant difference between the qualitative descriptors associated on the one hand with good Castillo–well managed, harvested and processed–and those associated on the other with good Caturra.

- In the Castillo v Caturra contest, one variety may not be demonstrably better than the other, but that doesn’t mean they are the same. Good Castillo and good Caturra are both good. But good in different ways. KSU tells us that good Castillo tastes fruity but not citrusy, with notes of dark chocolate and roasted nuts. Good Caturra tastes floral with notes of cocoa and caramel.

- The Kansas State results will be more fully developed over the coming months to complement deeper analysis of the traditional cupping results. Stay tuned.

.

WHAT I DID NOT SAY (THAT ALSO REALLY MATTERS).

- The correct answer to the question “Castillo or Caturra?” is “Yes.” Or at least, it is the answer we have been giving to growers in Nariño from the beginning of our Borderlands Coffee Project.

- Our allies in the marketplace have delivered a similar message. During the first gathering of our Advisory Council in Nariño, Geoff Watts of Intelligentsia told growers to plant Castillo to ensure production in the face of coffee rust. But not only Castillo. To diversify the varietal mix and include traditional varieties. Caturra, perhaps. Perhaps Typica. Or Bourbon. Or SL-28. Or Geisha. This stance reflects a dual strategy of mitigating production risk and seizing market opportunities for single-variety lots.

- Beyond generally supporting the idea of varietal diversification, our project has adopted a position of “varietal agnosticism” in terms of its support for renovation, investing in renovation with the varieties growers themselves choose. The majority of this coffee has been Castillo. Caturra is the second most-commonly selected variety. We have also supported propagation of Yellow Maragogype seed from the La Primavera farm of Corona Zambrano.

- The Trial data suggest that as a complement to Castillo, Caturra may not be the best varietal choice for growers pursuing a strategy of quality-based differentation, but that does not invalidate the strategy.

- Growers who plant heirloom and rock-star varieties may have a higher probability of producing quality-differentiated coffees (and the price premiums they can fetch in the marketplace), even though these varieties will likely generate lower yields than Caturra.

- In the end, what farmers are growing may be less relevant to the returns they get in the marketplace than who they sell it to and how; business model may be a more important determinant of price and margin than variety.

- Quality-based differentiation to increase prices is only one strategy to improve smallholder profitability. A more reliable strategy–but a more capital-intensive and circuitous path for many growers in Nariño–is to increase yields and efficiencies. These approaches are not mutally exclusive. The biggest gains in profitability will come to growers who can do both.