(Influenced heavily by these fantastic reference pieces Trading Practices for a Sustainable Coffee Sector – IISD, Jason Potts, with Guido Fernandez and Chris Wunderlich and by the International Trade Center’s – The Coffee Exporter’s Guide)

Recently, we’ve been working with the cooperatives participating in the Blue Harvest project in Central America to improve the commercialization of their coffee. For some of the cooperatives and farmers, we have created efficiencies by eliminating intermediaries, selling their coffee as green coffee rather than in parchment. We’ve also helped them find new buyers, which has allowed them to negotiate their contracts directly and hire services to mill and export their coffee, rather than just selling the coffee to the exporter and losing control over it at that point.

All of these efficiencies have helped these organizations capture more of the value of their coffee. Which is a great step up from previous arrangements, where coffee was given to the intermediary or exporter at the spot price of the day.

And yet there is a tradeoff – for the greater amount of value captured for the coffee, the greater the exposure to price risk for the cooperative or association.

Let’s look at the contract, the most fundamental tool for trading coffee. There are some tremendous benefits to being able to be a signatory party to a contract. It lets you have some predictability in what your price will be for your product, you have gained market information – what the buyer wants, when they want it and at what price and most importantly it gives you some voice in the supply chain.

Under ideal circumstances, when both parties are equally informed, the contract is an instrument that lays out the terms and conditions where the coffee passes title from the producer to the purchaser. However, there are systemic asymmetries in access to information and therefore this translates into limited bargaining power for many organizations.

We have seen some of this first hand with the Blue Harvest cooperatives. One cooperative signed a contract for FTO (Fair Trade Organic) coffee, yet the contract did not follow FLO guidelines by not including the prevailing country differential in the price (NB – FTUSA does not require that the price include the country differential). In this same contract, the price was fixed at $1.55, yet delivery is not for another 6 months, exposing the cooperative to increased level of price risk should the NY’C price go up.

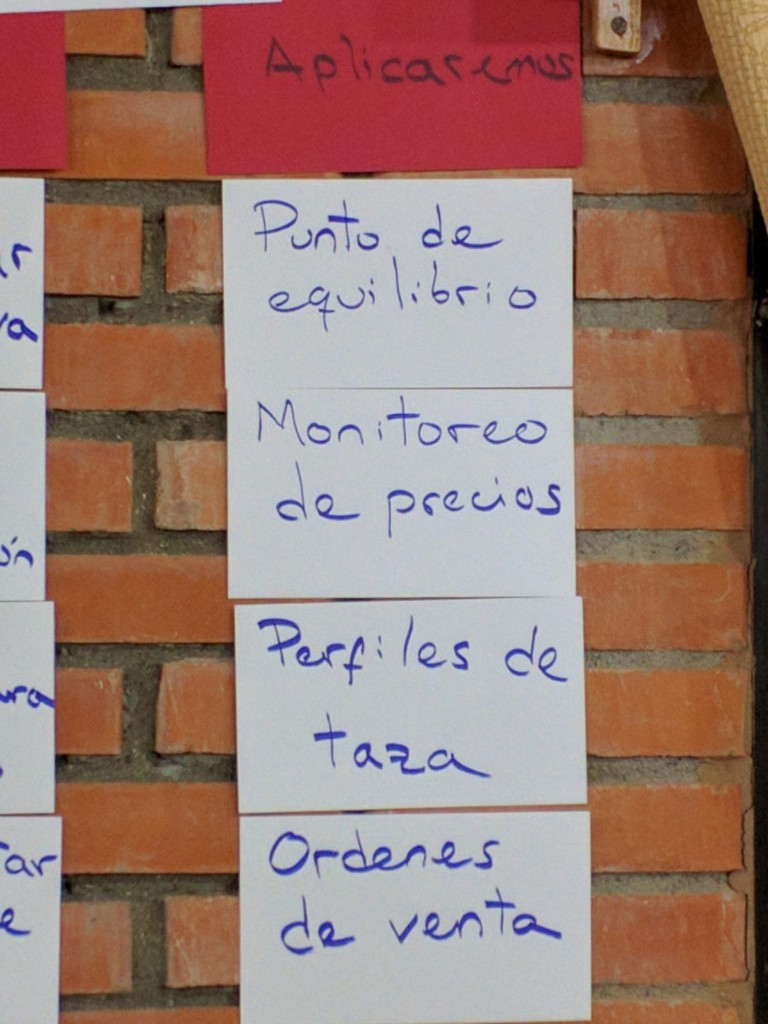

With these in mind, we wanted to review what some “best practices” are for negotiating and fulfilling contracts for cooperatives and associations, with an eye towards mitigating the exposure to price risk with specific types of contracts. Let’s start with some general guidelines.

- Always know what the current market price is (NY’C). This seems straightforward but is often forgotten that the price of your coffee is based on a global benchmark that moves up and down.

- Be aware of existing country differentials (prevailing diff) when applicable. There are different differentials for different countries and even different regions. They are part of contracts. It’s not always included, but as the adage goes – if you don’t ask for it, you won’t get it. Ask for the differential!

- When selling certified coffees, make sure to know certification specific requirements around pricing – this is especially important for Fair Trade (FLO & FTUSA) contracts.

- Pay attention to delivery time – that is the time coffee needs to be delivered to the buyer. It can significantly help or undermine the seller’s ability to fulfill a contract.

Let’s look at some specific suggestions for different types of contracts.

When signing OPEN/FORWARD CONTRACTS:

- Never fix before having collected at least 50% of the coffee – it is risky to fix a price before knowing exactly the real cost of the coffee you are selling!

- Make sure both parties on the contract agree on the timeframe within which it is OK for the seller (or the buyer!) to execute the price fix.

- Avoid shipping the coffee prior to executing the price fix. It is best to know what the final price is before handing over ownership title of the coffee.

When signing FIXED CONTRACTS

- Pay extra attention to the delivery time of the coffee. If the delivery time exceeds three months – from date of contract – there is high risk that market price can experience significant fluctuations and the contract price is no longer competitive, undermining the seller’s ability to collect coffee and fulfill the contract.

- If delivery time exceeds three months – from date of contract – it is recommended to consider the use of options to mitigate price risk

For cooperatives that have being doing this for a while, these suggestions may seem rather elementary. However, there are large number of cooperatives, farmer organizations and businesses that are either just starting, or have been struggling for quite some time. These are not the cooperatives that we read about in case studies nor do we encounter them at the SCAA. This is the tier of cooperatives and farmer-owned businesses who we need to become successful in order to secure our future supply of coffee.

– Kraig Kraft and Sara Morrocchi